Wheaton Precious Metals (TSX: WPM, NYSE: WPM; LSE: WPM) announced on Thursday agreements to acquire existing precious metals royalty streams on Ivanhoe Mines’ (TSX: IVN) Platreef project in South Africa and BMC Minerals’ Kudz Ze Kayah project in the Yukon.

Wheaton will pay US$450 million to Orion Mine Finance on closing for the Platreef and Kudz Ze Kayah streams, with an additional US$5 million contingency payment for Kudz Ze Kayah.

In addition, the company will pay US$20 million to an affiliate of Dalradian Gold to acquire a gold stream on the company’s Curraghinalt copper-gold-silver project in Northern Ireland, with another US$55 million payable during construction of the project.

“The acquisition of these diverse, high-quality streams fits seamlessly into our portfolio of high-margin, low-cost assets, with near-term production from Platreef significantly adding to our already robust growth profile,” Wheaton Precious Metals CEO Randy Smallwood said in a release.

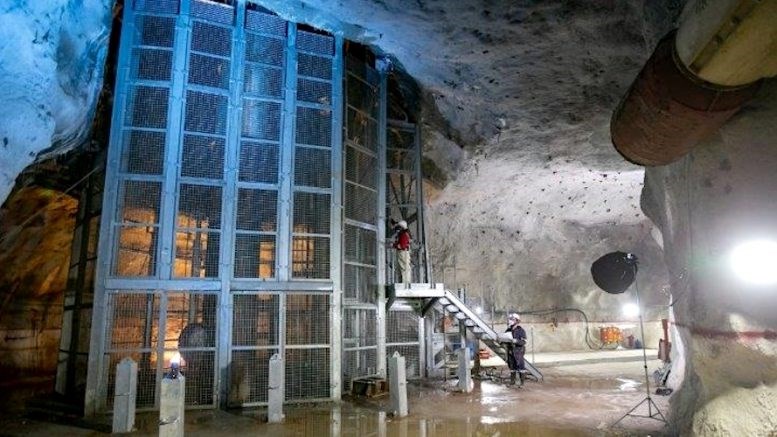

According to Ivanhoe, Platreef is the world’s largest undeveloped precious metals project. Attributable production at Platreef is forecast to average over 13,000 oz. of gold and 8,500 oz. of each of palladium and platinum per year for the first 10 years of production, increasing to over 24,000 oz. of gold and 13,500 oz. of each palladium and platinum per year for the following 10 years of production.

Commercial production is expected in the fourth quarter of 2024.

Shares of Wheaton Precious Metals rose 3% in late-morning trading on Thursday. The company has a $20.7 billion market capitalization.