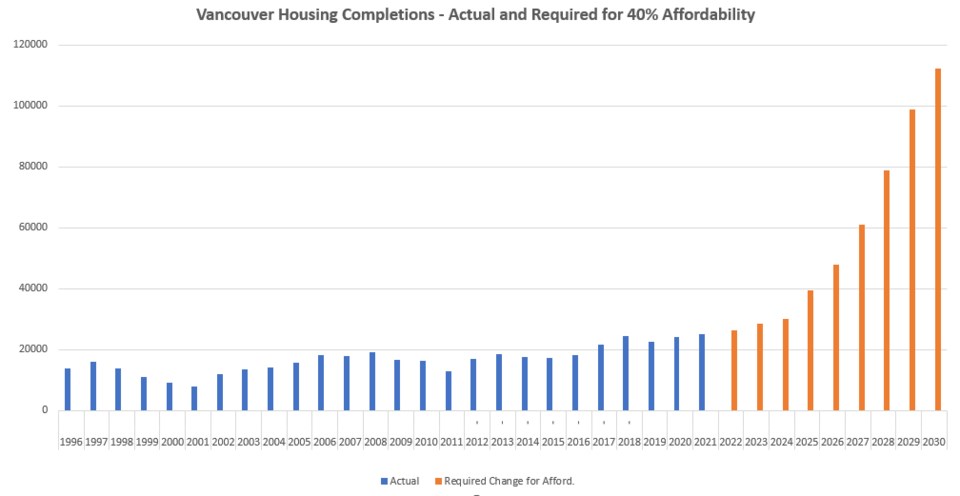

Metro Vancouver builders will have to construct about 523,530 units to deliver the number of units a Canada Mortgage and Housing Corp. study says is required to achieve a 40 per cent housing affordability rate by 2030, according to an analysis by Wesgroup, a Vancouver-based developer of units for both the owner-occupier and rental markets.

CMHC laid out the ambitious goals in a report that said B.C. as a whole would require 570,000 new homes beyond what’s usually built to achieve anything resembling affordability by 2030.

But with a current annual completion rate of 23,766 units, Wesgroup executive vice-president, development Brad Jones says it would take 26 years to meet that target – a goal the market alone simply can’t meet.

“When we look at the data, our first reaction was ‘how on earth are we going to react to that?’” he said. “It’s going to be an insurmountable challenge for the market to address.”

While the goal is laudable, a host of variables are stacked against achieving housing affordability, even if units are built. These include government policies, labour and development costs, not to mention the cost of financing for both builders and purchasers.

“It’s a startling challenge in our current context. It feels like a little bit of a perfect storm against affordability when you look at the level of construction that needs to happen,” he said.

Wesgroup dug into various datasets and found that building permit values in Metro Vancouver increased 79 per cent between 2011 and 2021, due to both extended approval times and rising construction costs.

“Developers are paying substantially more than ever before and they are waiting years to get a project going, if at all,” Wesgroup’s analysis found.

Meanwhile, the construction workforce grew by just 9 per cent over the same period even as the B.C. workforce at large increased at twice that rate. Restrictions on immigration and labour mobility during the pandemic as well as recent cost of living increases have further dampened workforce growth even as provincial projections indicate construction job openings require an additional 76,000 workers over the next decade.

“Some workers have relocated to a more affordable area, and some simply can’t afford to commute to and from work daily with current inflation and gas prices,” Wesgroup said. “There are less people to do this important work.”

While senior levels of government are taking steps to improve immigration processes, giving provinces more say over who they receive, and investing in workforce strategies, Jones said local governments have a key role insofar as they set the approval processes.

“We need our governments to make it easier to bring supply to market,” he said.

Without more supply, the cost of housing – units for sale as well as those for rent – will keep rising.

Jones is particularly concerned about the rental market.

“The rental market is going to be considerably strained for the foreseeable future,” he said.

Speaking at the Vancouver Real Estate Forum earlier this year, CIBC managing director and deputy chief economist Benjamin Tal said monthly rents are approximately a third lower than home ownership costs. With the supply of all housing types lagging, rental costs have nowhere to go but up.

“Rent inflation is in the cards over the next few years,” he said. “We simply don’t have enough rental units and too much demand. In fact, we have more demand than we know. … Whatever the supply issue we have, it’s worse.”

According to Rentals.ca, the average rent for a two-bedroom apartment in Vancouver rose more than 26 per cent in June versus a year ago to $3,597 a month. One-bedroom rents rose 19 per cent to $2,412 a month. While the increases were more modest further out from the core, all areas posted increases.

While some developers have attempted to address costs by reducing the size of units, this has not reduced the cost to owners and tenants.

Rentals.ca data indicates that Vancouver has the highest monthly rental rates for condo and purpose-built rental apartments while having the smallest average unit sizes, with the average 743-square-foot unit listed on the site leasing for $2,731 a month.

In fact, the smaller the unit, the greater the cost per square foot. Rentals.ca data for June indicates that a unit in the range of 1,000 square feet fetched approximately $3.80 a square foot while a 400-square-foot unit listed in the range of $4.62 a square foot.