OTTAWA — The country's biggest civil service union says it will contest a decision that would see government workers pay tax on money they receive as part of a settlement reached over long-standing problems with their paycheques.

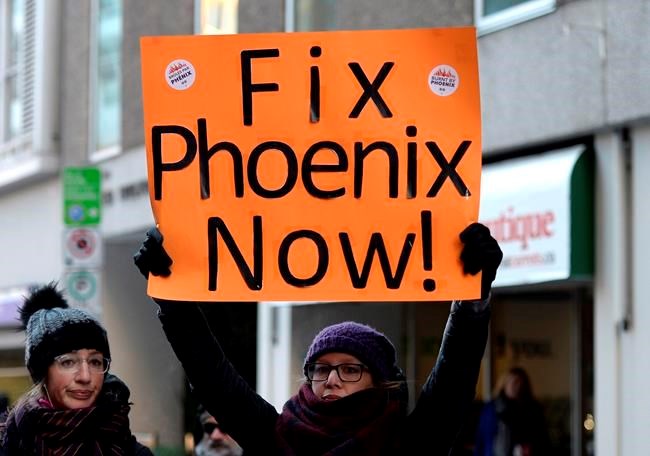

The federal government and the Public Service Alliance of Canada (PSAC) reached a deal last summer to compensate the union's 140,000 members affected by failures in the Phoenix pay system.

The agreement would see workers paid up to $2,500 in general damages for four years of pay problems including delays, overpayments, underpayments or lack of pay.

A letter provided to PSAC by the Treasury Board Secretariat says the Canada Revenue Agency has concluded those payments are taxable.

The union says the letter is not a formal tax ruling and will dispute it on the basis that the CRA has determined that other specific damages in the settlement are non-taxable.

Treasury Board also announced Thursday that it has launched a new claims process to compensate current and former employees who experienced severe personal or financial impacts as a result of issues with the Phoenix pay system.

The new process was called for as part of a separate agreement reached in June 2019 with other unions to compensate approximately 121,000 current and 25,000 former employees.

This report by The Canadian Press was first published January 14, 2021.

The Canadian Press