There are few regions in B.C. that did not see a significant rise in residential property values, according to the most recent BC Assessment reports released Jan. 4.

Whereas most regions saw property values increase by roughly 15% to 35%, some of the province’s northern municipalities realized fewer gains. In fact, only the tiny district of Taylor saw a negative gain, at -4% for a detached home property, according to BC Assessment. Meanwhile, Kitimat posted a 0% change over last year for detached homes.

The municipalities or districts of Cheywynd, Dawson Creek, Pouce Coupe, Hudson’s Hope and Fort St. John all saw detached home properties gain by less than 10%.

“Northern B.C. property values for most communities are generally up five to 35% with only a couple of exceptions,” stated northern B.C. deputy assessor Beau Rossel, adding that overall, northern B.C.'s total assessments increased from over $72 billion in 2021 to over $81.7 billion this year.

Meanwhile, Kootenay Columbia's total assessments increased from about $49.8 billion in 2021 to almost $60.7 billion this year; Thompson Okanagan's total assessments increased from $159.3 billion in 2021 to $204.2 billion; Vancouver Island's total assessments increased from roughly $269 billion in 2021 to $343 billion this year; and, finally, the Lower Mainland region, the overall total assessments have increased from about $1.46 trillion in 2021 to about $1.75 trillion.

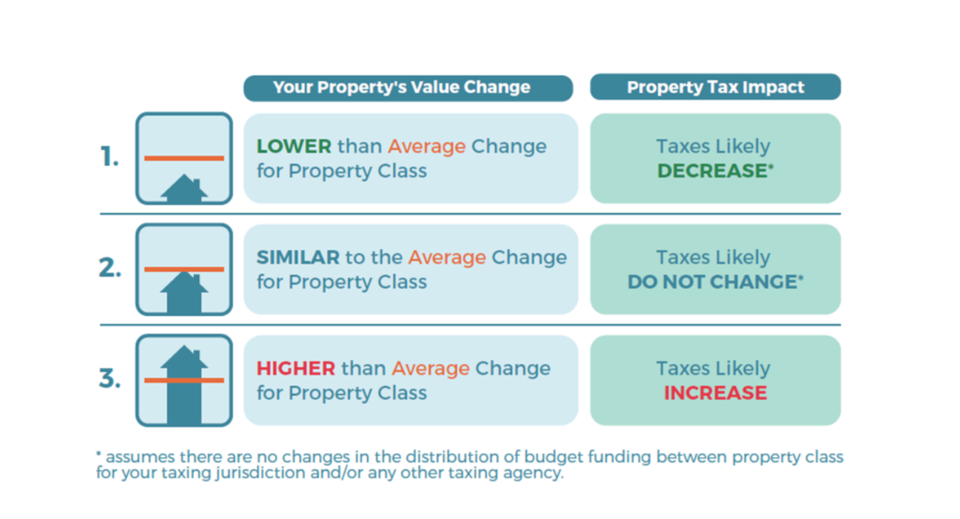

While property taxes are based on a property’s value, the increases do not necessarily translate into higher taxes.

Each city, town or district will set a new tax rate this year and apply that rate to a home’s value. One’s property tax will only increase above the set rate if the property’s value increased higher than the average change across the same property class for that city, town or district.

Likewise, if a property’s value increased less than others, on average, a lower tax bill will be realized (although the decrease in the relative amount owed may not necessarily offset any potential overall increase set by the new rate, which is predicated on annual city hall expenses).